I’ve recently taken a class in CBS on factor investment strategies and I thought it’d be really cool to share some of the results I found while writing a paper. 😎

I’ve always been interested in investing but I’ve never been a fan of buying stocks (or other investment vehicles) by word of mouth, because they’re trendy or simply based on gut-feel. I’d prefer to do my due diligence: conduct some form of independent research and ascertain the vehicle’s value before buying it.

But alas, I have zero background in corporate finance, nor do I know how to conduct deep-dives into financial statements, and I don’t have time to regularly pore through companies’ annual reports before deciding what stocks or bonds I’d like to buy.

So this is where I think factor investing offers a nifty solution.

Factor Investing

Very simply put, factor investing involves choosing securities (or just stocks) based on characteristics that are associated with higher returns. Common characteristics include size (buy small stocks), value (buy cheap stocks) and quality (buy good quality stocks).

What???

To illustrate, buying stocks based on the size characteristic simply involves calculating the market capitalisation of all companies in the market, then buying the stocks of say, the bottom 30% of companies based on this metric.

On the other hand, buying stocks based on the quality characteristic could involve calculating the return on assets of all companies in the market, then buying the stocks of the top 30% of companies based on this metric.

That’s it?

There is in fact a multitude of characteristics and ways to proxy for these characteristics (briefly discussed here), but they are beyond the scope of this article.

And how is this a “solution”?

Choosing stocks based on their characteristics,

- satiates my need to conduct fundamental/ quantitative (albeit hasty) research before buying anything, and said research

- can be implemented easily over a large number of stocks, which

- implies that if I do execute my factor investment strategies, my portfolio is diversified.

So how well do factor investment strategies perform?

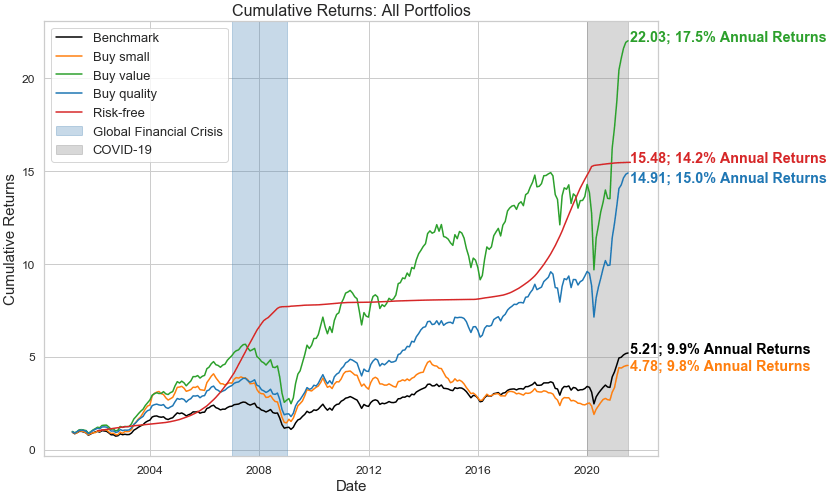

I’ve chosen to create portfolios of stocks based on the value, quality and size characteristics, and here’s a quick plot of their cumulative returns:

The graph above indicates that if you’ve invested $1 into the portfolios built from the value and quality characteristics in 2001, the $1 would have turned into $22.03 and $14.91 respectively in June 2021 🤩. These translate into annual returns of roughly 17.5% and 15.0% respectively. 🤩🤩

The outcomes would have been markedly different if you had invested $1 into the benchmark portfolio, which is a naive strategy of simply buying every single stock there is in the market, or the portfolio built from the size characteristic.

All portfolios seem to even be COVID-proof. 😱

Dataset, the nitty-gritty, and some caveats

Now that I’ve hopefully gotten your attention, these numbers come with several important notes.

Dataset

Related to the dataset:

- the graph above is derived from US stocks from January 2001 to June 2021,

- the stocks comprise of 15,823 companies that are both still active or have gone inactive, averaging 94 months of available data, and

- the dataset is obtained from the Wharton Research Data Services/ Compustat,

while some important notes concerning my data processing steps are my choices to:

- limit return rates to the 99th-percentile return rates of all companies in each month, because some companies report extremely high (and unlikely) monthly returns on certain months and these high values distort my portfolio performances quite significantly,

- remove financial firms from the pool of these stocks, and

- keep micro-cap stocks in this pool of stocks even though they might introduce complexities such as poor fundamental data quality, with some literature also claiming that they bore little economic relevance.

Building the portfolios

Beginning with the simplest, the benchmark portfolio was constructed simply through buying all stocks available in the dataset. Companies can come and go throughout the 20-year horizon, so the basket of stocks that make up the benchmark portfolio can in fact comprise of different stocks month-on-month, over the years.

The portfolio based on buying small stocks is built by:

- computing the market capitalisation for every company on a monthly basis,

- ranking all companies by their market capitalisation values, and

- buying the bottom 30% companies based on this metric.

As the market capitalisation is calculated every month, the stocks that make up this “small-stocks” portfolio can therefore also change month-on-month.

The portfolios based on buying value and quality stocks follow a similar logic, except value stocks involve buying top 30% companies by book-to-market ratios, and quality stocks involve buying top 30% companies by return on assets.

Are the returns in fact any good?

If it was so easy to construct these portfolios, where I simply have to buy stocks based on some easily calculated metrics, what’s stopping every other investor from doing the same and then eventually arbitraging away any excess returns that might be associated with these characteristics?

Indeed, there are loads of literature debating if the size characteristic/ factor still remains, while many assert value and quality’s presence. Regardless, I compare all portfolios to the U.S. 4-week T-Bill rates — where the T-Bill is a relatively risk-free asset — to test if my actively managed portfolios are able to outperform an asset that requires relatively less investor involvement and entails lower risks.

As the line in red suggests, consistently investing in the T-Bill could yield similar to much better returns than just simple factor investing.

In sum

I’ve barely scratched the surface of factor investing, and there are in fact countless other nuances that could be considered. On top of various other characteristics/ factors, there are different ways to proxy for these characteristics, different ways of weighing the returns of each stock in every portfolio, and even the possibility of combining short-selling and going long on stocks, instead of the long-only portfolios that I have described.

Nonetheless, I think this exercise was a pretty good prelude either to fundamental analysis, to fancier combinations of factor investing, or simply a reassurance that sometimes risk-free assets are the way to go for the uninitiated. 😅